Binance, one of the world’s largest cryptocurrency exchanges, has established itself as a robust platform for handling orders and trades with remarkable efficiency. The process begins when a user places an order on the Binance platform, which can be either a market order or a limit order. Market orders are executed immediately at the best available price, while limit orders specify the exact price at which the user wishes to buy or sell an asset. This flexibility allows traders to implement various strategies depending on their risk tolerance and market outlook.

Once an order is submitted, it enters Binance’s sophisticated matching engine-a core component designed to pair buy and sell orders swiftly and accurately. The matching engine operates based on price-time priority; this means that among all pending orders at a particular price level, those placed earlier get matched first. This system ensures fairness by honoring both price competitiveness and time precedence in trade execution.

Binance employs high-frequency trading technology capable of processing millions of transactions per second with minimal latency. Such performance is crucial given the volatile nature of cryptocurrency markets where prices can change rapidly within milliseconds. By maintaining low latency in its matching engine, Binance minimizes slippage-the difference between expected relevant background information transaction prices and actual execution prices-thereby protecting users from unfavorable trade outcomes.

When two compatible orders are identified-such as a buy limit order meeting a corresponding sell limit order-the exchange executes the trade instantly by transferring ownership of assets between users’ accounts internally on its ledger system. This internal ledger update happens without delay, reflecting new balances almost instantaneously so that traders can continue engaging in further transactions without waiting for blockchain confirmations.

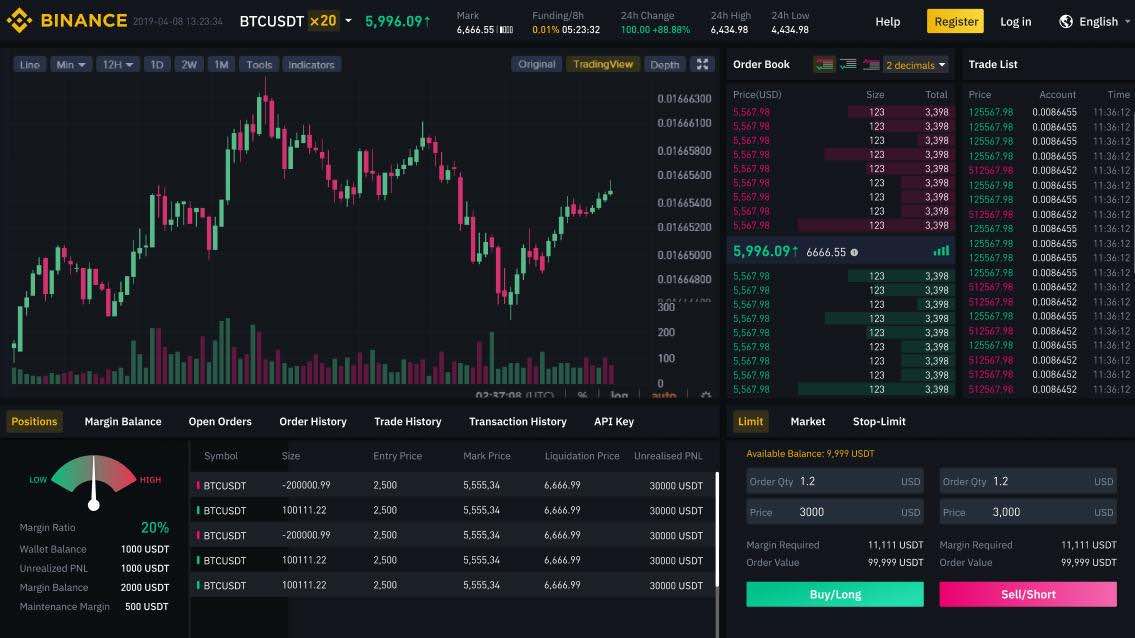

In addition to basic spot trading, Binance supports margin trading and futures contracts which introduce additional layers of complexity in how trades are handled. For instance, margin trading involves borrowing funds to increase position size; hence Binance must continuously monitor collateral levels to manage liquidation risks effectively if market movements become adverse for leveraged positions.

Security measures also play an integral role during order handling by ensuring that all trades comply with regulatory standards and internal policies aimed at preventing fraud or manipulation attempts. Binance uses advanced algorithms for real-time monitoring of suspicious activities alongside multi-factor authentication protocols safeguarding user accounts throughout every stage-from placing an order through final settlement.

Furthermore, Binance provides transparent access to detailed trade histories and real-time market data via APIs enabling institutional clients and algorithmic traders to integrate seamlessly into their own systems while leveraging Binance’s powerful infrastructure.

Overall, Binance’s approach combines cutting-edge technology with stringent security practices facilitating smooth execution of millions of trades daily across numerous crypto pairs worldwide-making it one of the most reliable platforms in today’s digital asset ecosystem.